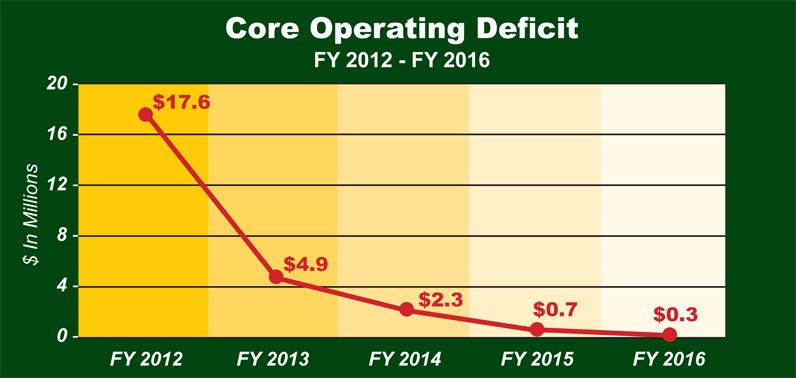

New financial statements for the Archdiocese of Philadelphia released Nov. 3 by the Office for Financial Services covering the fiscal year (FY) ended June 30, 2016 show continuing progress on the path to financial stability, especially in addressing the core operating deficit.

The financial statements, which were audited by the independent auditing firm Grant Thornton, show the core operating deficit for FY 2016 to be $0.3 million as opposed to $0.7 million in FY 2015.

That is down from $2.3 million in FY 2014, $4.9 million in 2013 and a whopping $17.6 million in 2012, the first year of Grant Thornton’s audits.

[hotblock]

Over the same period, underfunded balance sheet obligations have decreased from $354.4 million to $236.6 million.

“Our recurring deficit of $300,000 shows well and continues our recent trend of a somewhat stabilized result,” said archdiocesan Chief Financial Officer Timothy O’Shaughnessy. “It’s a deficit though and we’re still too fragile. I don’t believe we can sustain even at this slight deficit without further changes. We are committed to achieving a break-even result for our fiscal year ending June 30, 2018 and we are reviewing plans for that. These plans do not include a reduction in staff.”

The just-released reports do not include results for such entities as the Office for Catholic Education, Catholic Health Care Services, St. Charles Borromeo Seminary or the Heritage of Faith — Vision of Hope Capital Campaign. Each will release their audited financial statements in the near future, as in recent years past.

In the case of the World Meeting of Families entity, for which audited statements were released Nov. 3, “The World Meeting of Families team did a great job managing this event to a break-even financial result,” O’Shaughnessy said. “The fundraising effort and the generosity of so many donors that made it possible was so very well done – raising and collecting $45.8 million versus our goal of $45 million.”

The reports also do not include financial figures for the parishes of the archdiocese, which are autonomous and independent entities.

Looking back over the four years, a great deal of progress has been made to address underfunded balance sheet obligations.

The Deposit and Loan Fund, which includes interest-earning deposits from parishes to be loaned to other parishes with needs, had an unfunded balance of $82 million in 2012. This has been reduced to $39.6 million, and it is believed that obligation can be met through the sale of pledged assets.

[hotblock2]

The Risk Insurance underfunding that stood at $30.4 million has been completely eliminated. The Priest’s Retirement Plan, which was underfunded by $90 million, is now underfunded by $12.3 million.

The Lay Employees Retirement Plan, which has assets of approximately $445 million and an estimated liability of $629 million, is underfunded by approximately $185 million.

The plan, which is a defined benefit plan, guarantees a fixed lifetime income to its eligible participants. However, over the years life expectancies have increased, and past contributions based on now-outdated mortality tables were not sufficient to the need.

In recent years investment returns, which have been less than expected, also contributed to the shortfall.

Now for its future retirees the archdiocese has switched to a defined contribution plan with benefits based on the amount contributed, just as many other pension plans have done. The archdiocese distributed $100 million to eligible participants who chose a buyout, and is gradually making extra contributions that will address the shortfall.

“We made an unplanned contribution of $7.5 million during the year ended June 30, 2015 and we are evaluating the possibility of another large unplanned contribution for this year,” O’Shaughnessy said.

Very clearly, the dramatic reduction of underfunded liabilities over the past four years was made possible in large part by the sale of such assets as the archdiocesan nursing homes, Mary Immaculate Seminary and the long-term lease of the archdiocesan cemeteries.

But the real story is the measures taken to achieve a balanced budget, which is true progress that may make future sale of assets unnecessary.

PREVIOUS: 2015-2016 Audited Financial Statements of the Archdiocese of Philadelphia

NEXT: Catholic women celebrate ‘spiritual sisterhood’ at shrine

You my dear Bisop are doing a fantastic job. God and I love you very much. Paul